This page shows the current, proposed, and pending federal and state law and rules governing the MHD, including the Texas Manufactured Housing Standards Act, Chapter 1201 of the Texas Occupations Code, as well as the TDHCA Manufactured Housing Rules, 10 Texas Administrative Code, Chapter 80, as well as a summary of Rule Amendments, including a link to view historic/old versions of the law and rules.

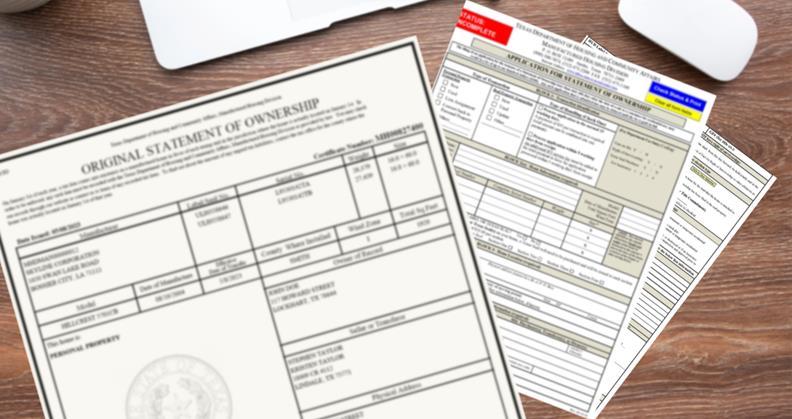

Search here for home ownership records, such as selling retailers, details about a manufactured home, tax lien records, find reports such as count of ownership records and monthly titling report per county by month or production summary by manufacturer, as well as license holder, installation and inspection records.

A list of links to previous announcements that have been on the main Manufactured Housing Division home page and License Holders' page.

Find an overview of the Manufactured Housing Division, see our governing principles, and learn what the government charges the Department with responsibility for. Also describes the 5-member Manufactured Housing Board, lists members and their biographies, and includes information about upcoming and historical board meetings.

Contains links to previous news stories and items shared on the MHD News section.

View some of our most frequently asked questions at the Manufactured Housing Division, and their answers, including questions about our titling document, the Statement of Ownership, as well as topics of Licensing, Consumer Protection, and Tax Liens.

Manufactured Housing Mailing List

Subscribe to the Manufactured Housing Mailing List